- SureGroups

Empowering Groups

to Thrive Together

SureGroups helps groups register businesses, connect members, and access loans, efficiently, securely, and seamlessly.

Platform Features

Business

Registration

We assist you in officially registering your association or group business in minutes.

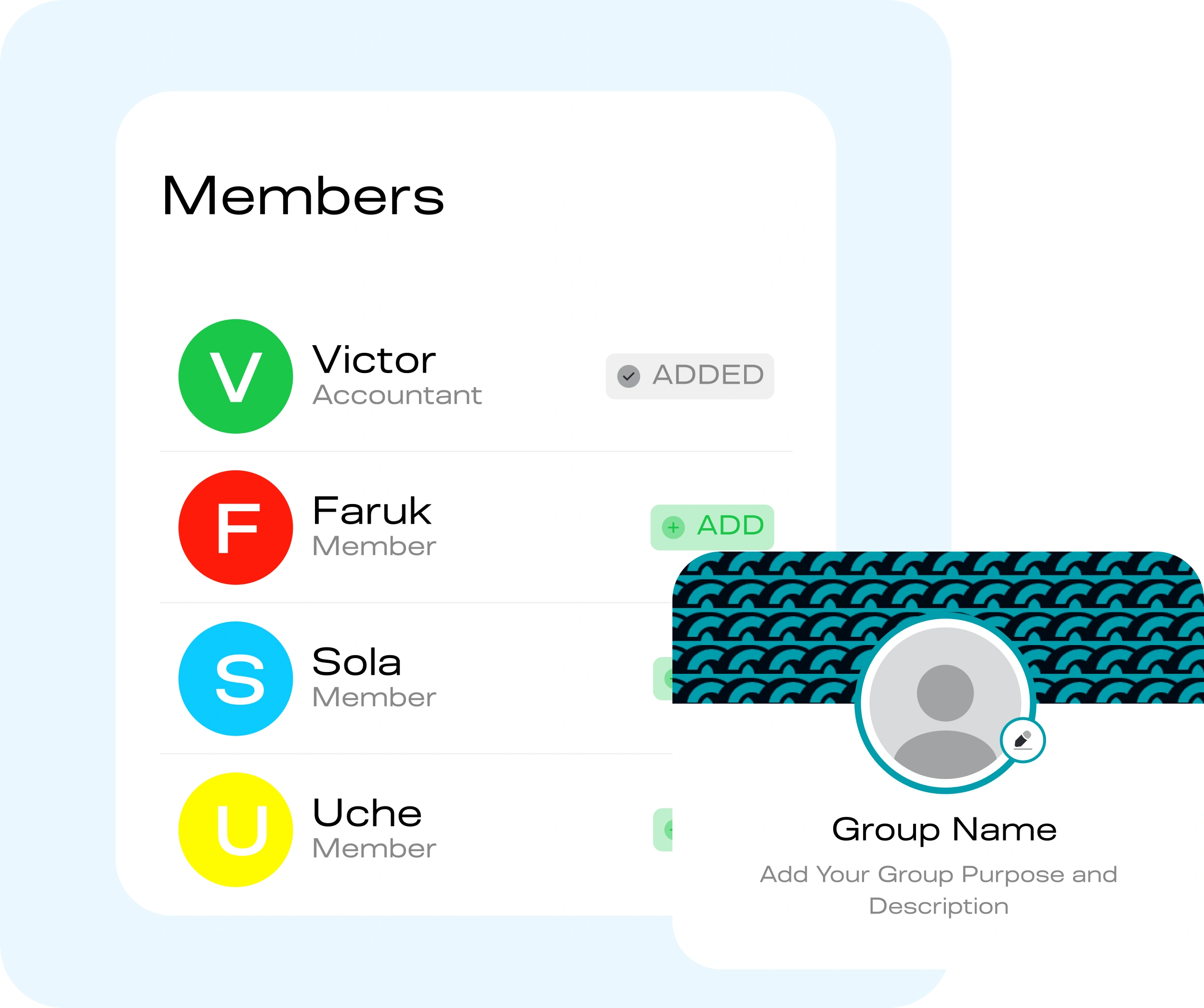

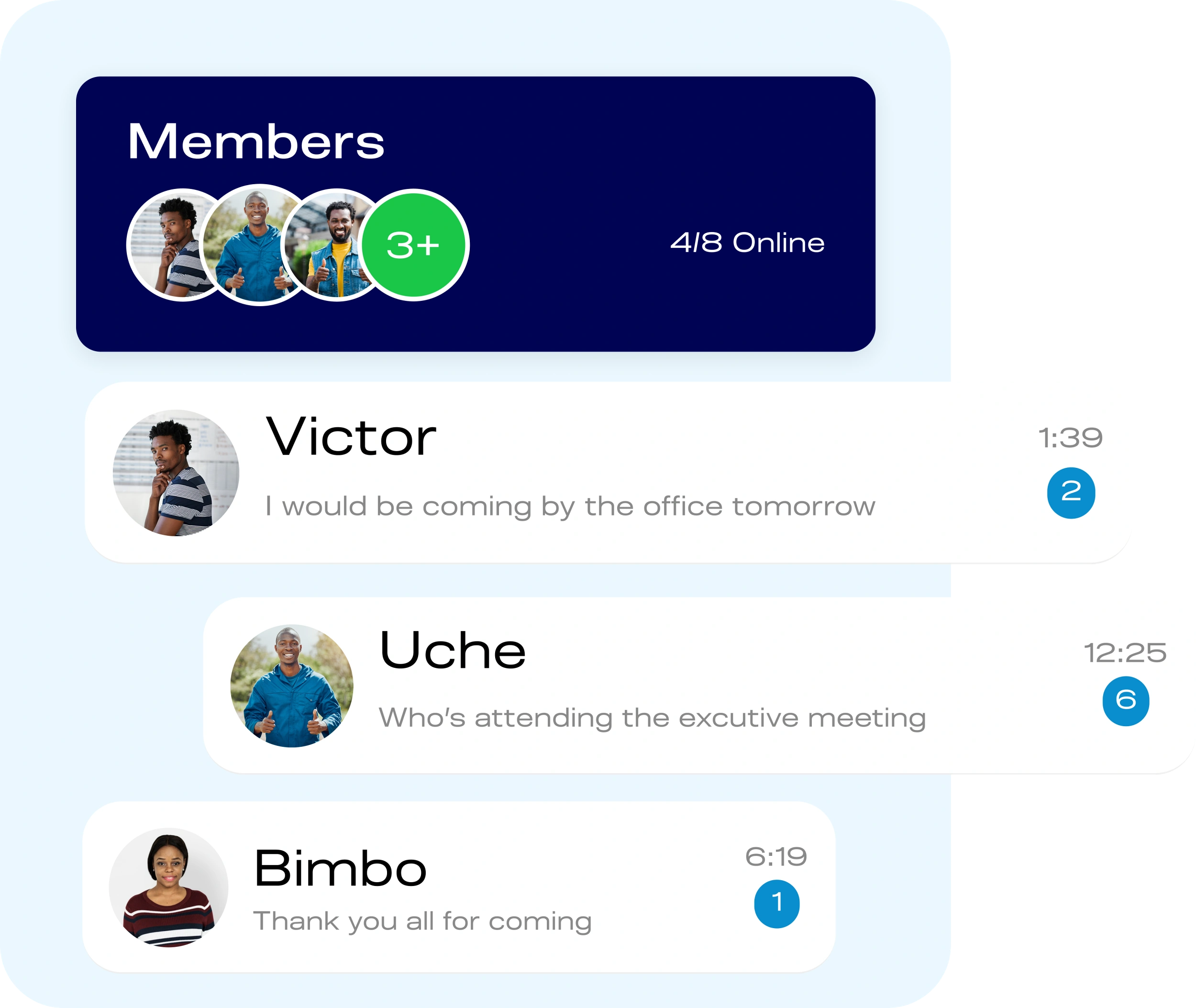

Member

Chat

Stay connected! Group members can chat, share updates, and collaborate in real-time.

Access

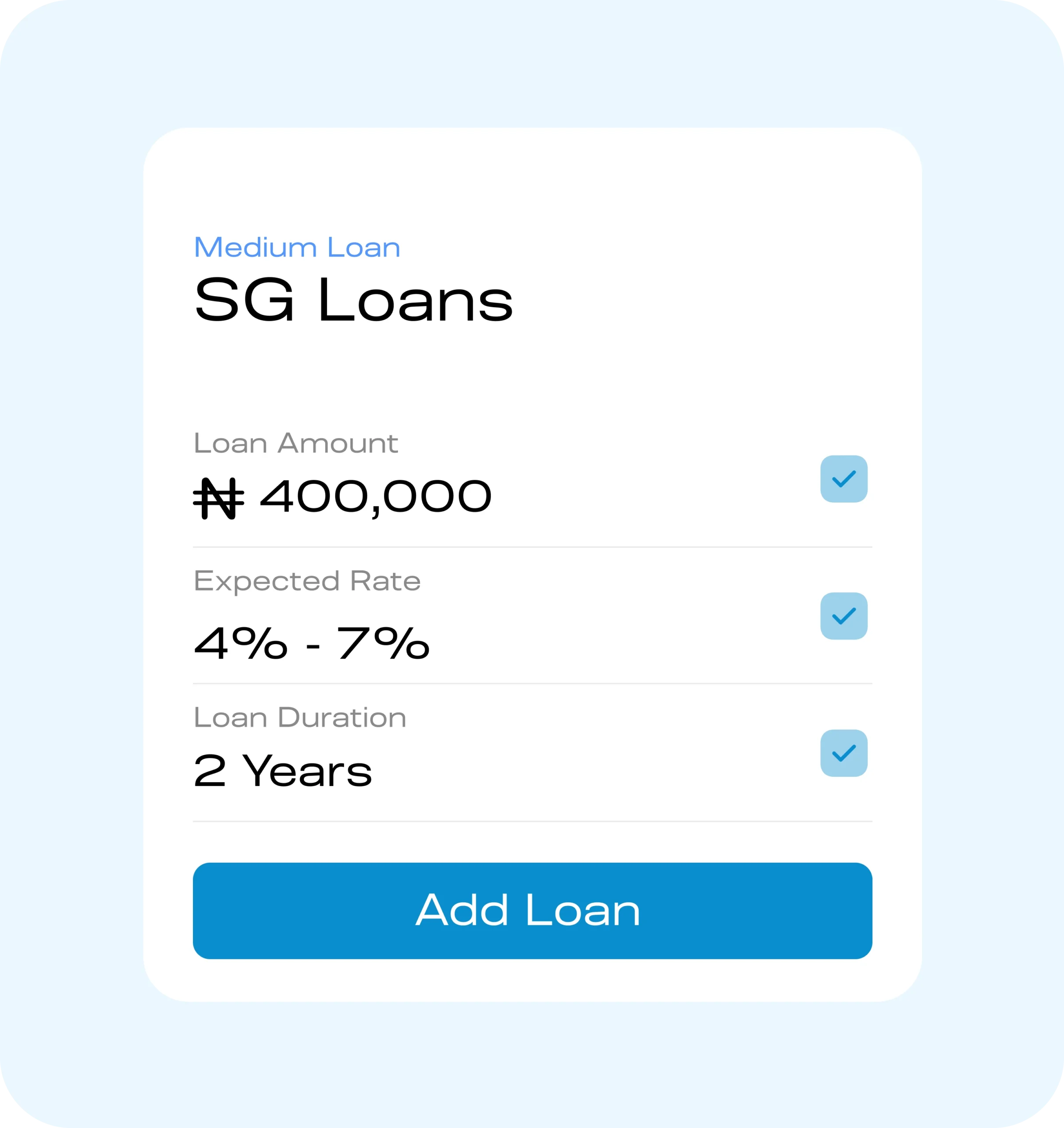

Loans

Qualify for group-based microloans and financial assistance based on your group’s activity and structure.

Training

Programs

Equip your members with skills and knowledge through targeted training programs and workshops.

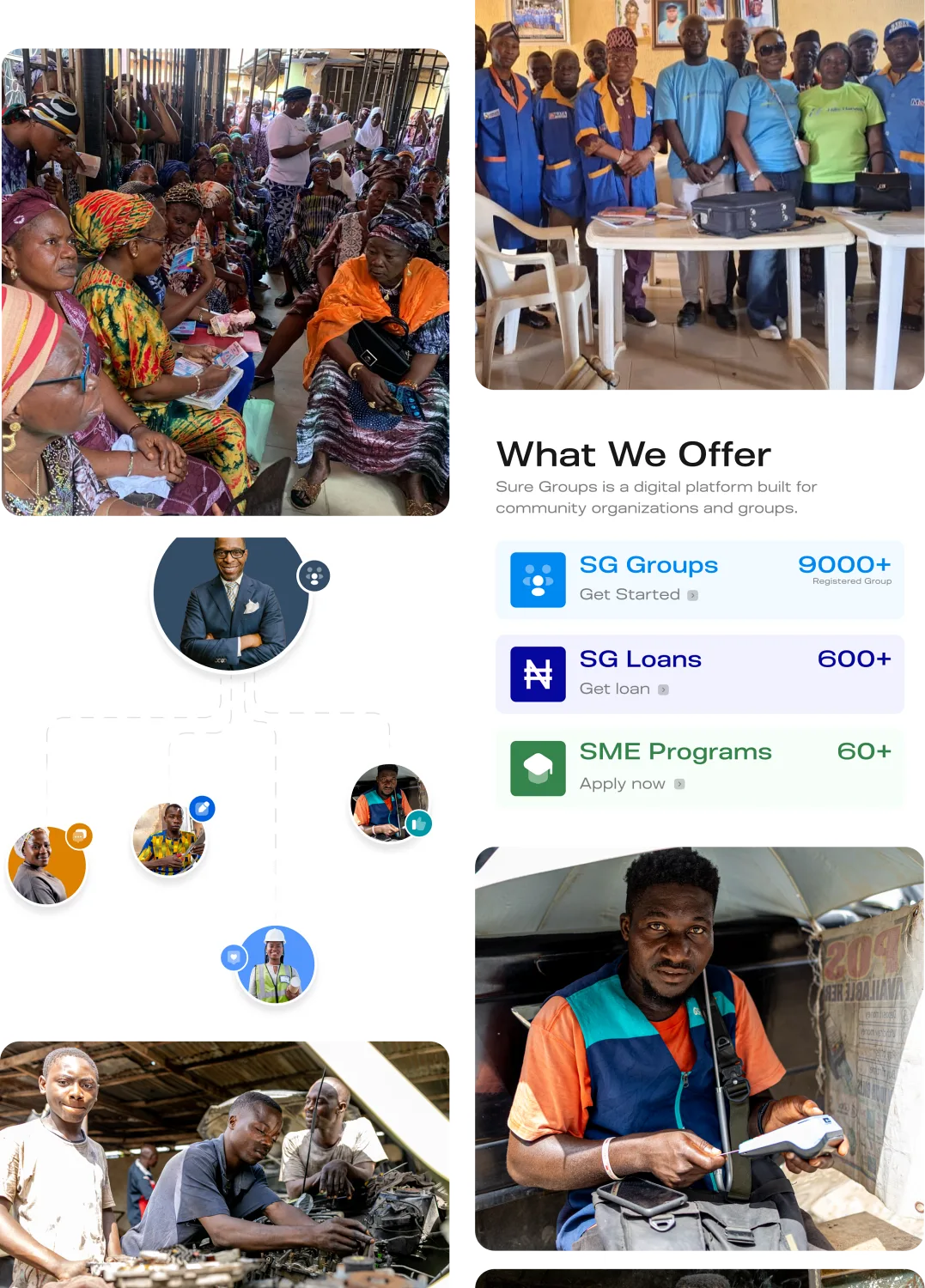

About Us

Powering

Community Growth

SureGroups is a powerful digital platform built to empower associations, cooperatives, unions, and community-based organizations through seamless onboarding, verification, certification, and management. As a product of the Finclusion Ecosystem, SureGroups connects both informal and formal organizations with financial institutions, regulatory agencies, digital infrastructure, and strategic partners—ensuring trust, transparency, and access to life-changing opportunities.

How SureGroups Works

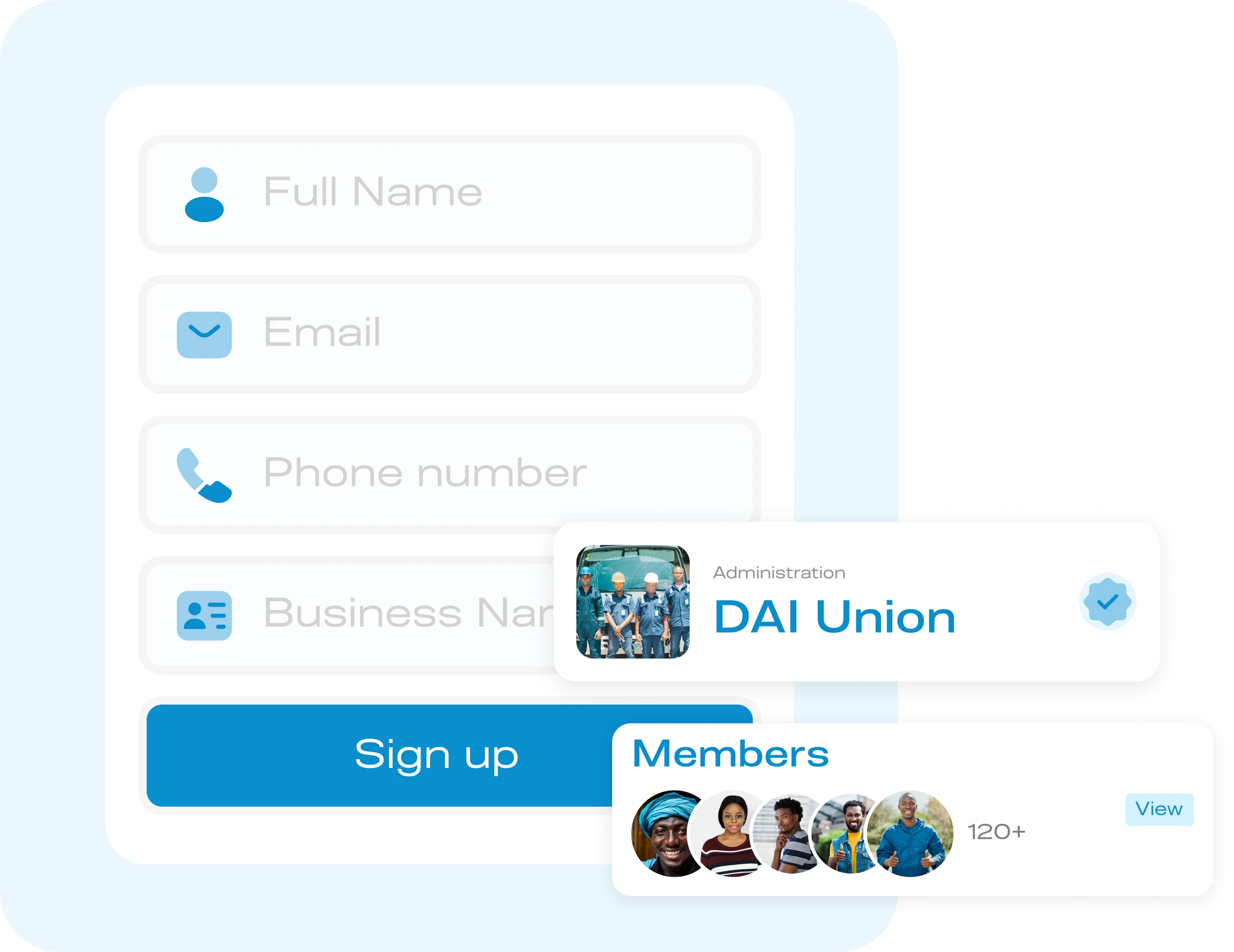

- Register Your Business

- Create a Group

- Members Connect

- Apply for Loans

Register Your Business

Complete your official group or business registration through a simple, guided process. Upload necessary documents and receive support as you comply with government requirements. Once approved, your group gains legal status and access to more features like funding and training.

Members Connect

Easily invite group members via email, SMS, or direct links. Once added, members can communicate in real-time, share ideas, receive updates, and collaborate on projects. The chat feature helps strengthen internal communication and community engagement, ensuring everyone stays informed and connected across all devices.

Apply for Loans

Once your group is active and verified, you can explore financing options. Submit applications for group-based microloans directly through the platform. Loan eligibility is based on group activity, credibility, and consistency. Our team reviews and supports you throughout the process to boost your financial capacity.